Growth slows, but glass and glass industry sentiment remains positive.

After several years of strong growth, the U.S. architectural glass and glazing industry remains stable in 2024, according to Key Media & Research's Glass and Glazing Industry Outlook 2024.

The wider market

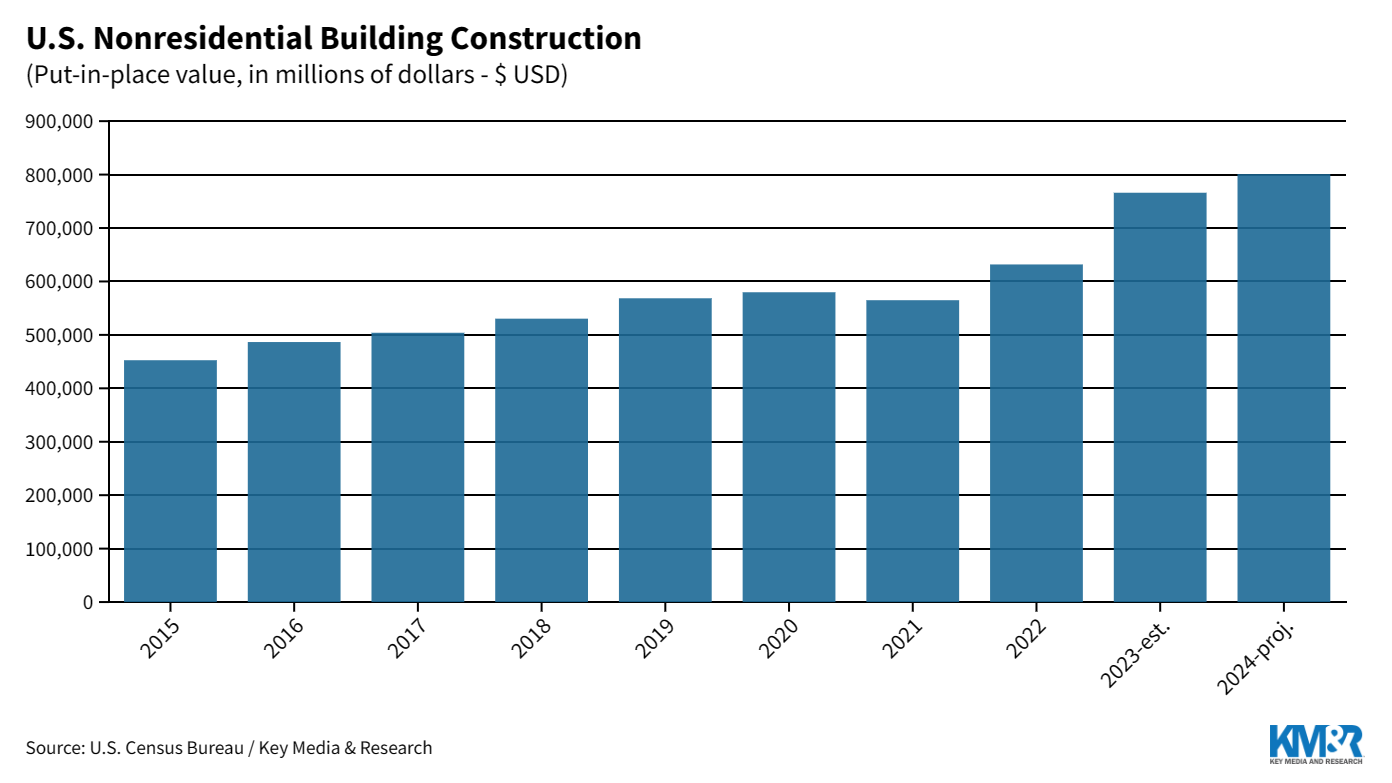

Overall non-residential construction values are expected to grow modestly after significant double-digit percentage increases in the previous two years. The value of residential construction increased significantly from 2019 to 2022, but as expected, it fell back in 2023. It is expected to be flat in 2024, with potential for slight growth.

Figure 1 The U.S. nonresidential glass and glass construction

In addition to pandemic-induced declines in 2021, spending on nonresidential glass and glass construction is expected to flatten over the next two years after decades of solid year-over-year growth. Architectural glass-related activity in multifamily construction surged in value in 2022 before falling back in 2023. The recent downward trend should continue to a lesser extent over the next two years.

U.S. glass contractors are increasingly bullish on the institutional sector (i.e., healthcare and education) over the commercial sector, which was previously driven by office buildings. The 40 largest glazing contractors (by annual revenue) have collectively peaked over the past few years but remain at overall high levels.

The Industry Outlook

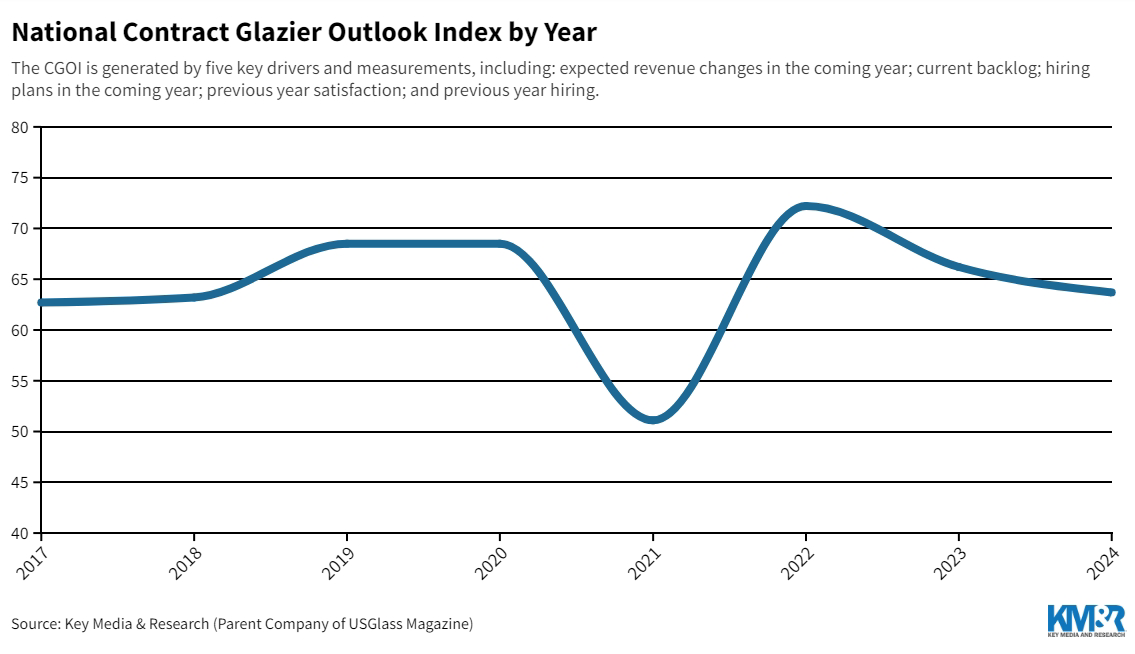

The Contract Glazier Outlook Index, a numerical indicator that measures the current status and prospects of the U.S. glass and glass industry, indicates that the outlook remains stable but not as optimistic as in recent years.

Figure 2 The National Contract Glazier Outlook Index by year

Year-over-year sales expectations for glazing contractors remain mostly positive heading into 2024, with backlogs increasing over the past 12 months for most companies.

The proportion of contract glaziers hiring additional staff increased in 2023 and is expected to fall in 2024 – although more than two-thirds of glaziers still plan to increase their headcount.

The other noteworthy

After several years of sharp increases, prices for flat glass and metal fenestration products have fallen slightly and remained flat, respectively.

Going into 2024, glass suppliers are mostly optimistic from a sales perspective, but the overall focus is on key economic factors. Architectural glazing system suppliers are less optimistic than glass contractors and glass manufacturers. Glass retailers, meanwhile, have mixed expectations for the year ahead.

Similar to recent years, transportation and metal fabrication are the two most popular types of machinery and equipment that glass contractors plan to invest in 2024, according to KMR survey data. More than two-thirds of glass manufacturers participating in the industry outlook survey said they will purchase large quantities of machinery in 2024.

Disclaimer: The above views do not represent the position of LIJIANG Glass, and the copyright belongs to the original author and source. The content of News is the author's personal opinion, and it does not mean that LIJIANG Glass agrees with his opinion and is responsible for its authenticity. LIJIANG Glass only provides references and does not constitute investment and application advice.